jersey city property tax delay

Jersey City homeowners who were whacked with a whopping third-quarter property tax bill should brace for another stinging blow in the final quarter of 2022. Grace periods extend to the 10th of these months and an interest charge will be.

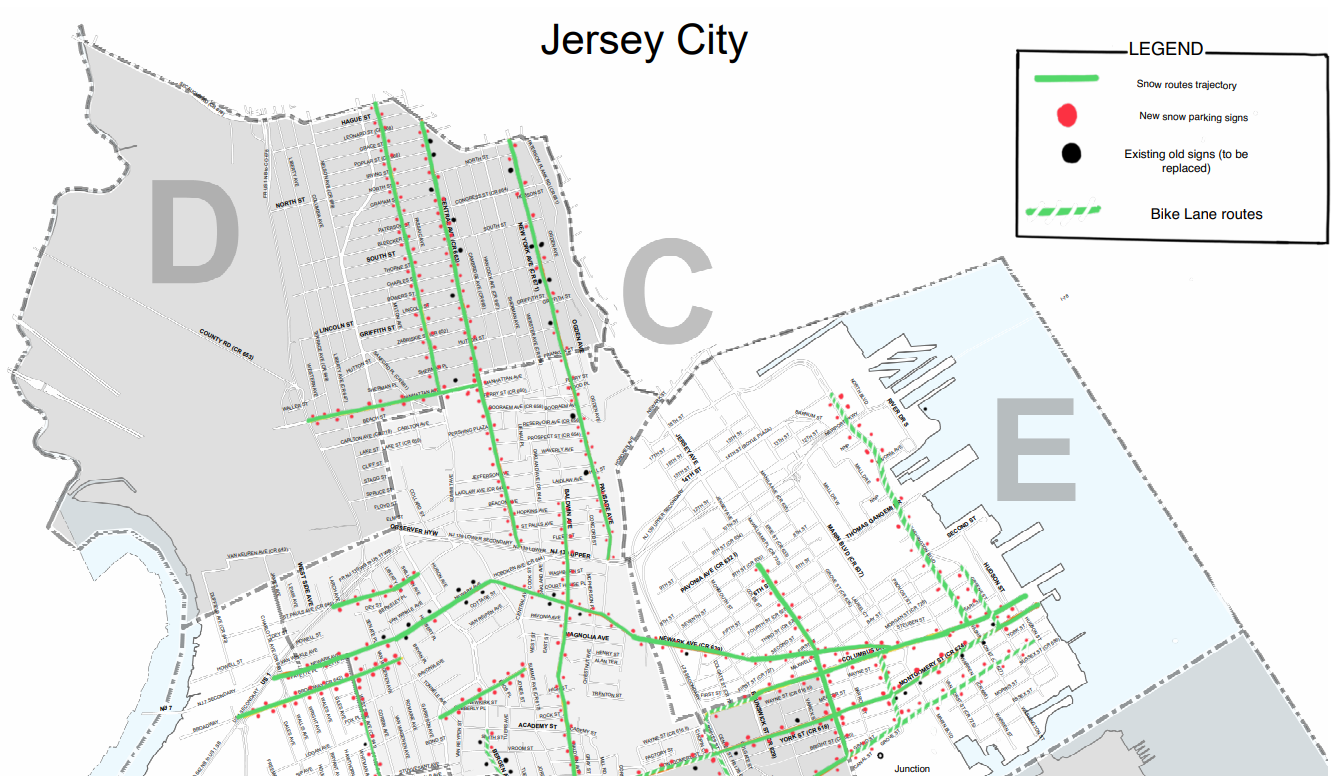

Winter Weather Updates City Of Jersey City

Online Inquiry Payment.

. The average New Jersey property tax bill in New Jersey was 9284 in 2021 among the highest in the nation. I did get an email from Jersey City OEM about it. Jersey City property taxes are due quarterly on February 1 May 1 August 1 and November 1.

Rough figures from the ANCHOR program average a 971. Bill S4065 increases the taxable income phase-out threshold to 150000 of taxable income. Counties in New Jersey collect an average of 189 of a propertys assesed.

Jersey City taxpayers would normally be granted a 10-day grace period to pay their tax bill meaning you could pay your taxes until August 10 th if it was issued on August 1 st without. September 30 2022 0424h. JERSEY CITY NJ Homeowners in some parts of Jersey City are horrified by their new taxes after the citys first revaluation in decades.

Originally scheduled to begin in November. Rubenstein claims that Fulop is trying to delay the revaluation to shelter downtown neighborhood property owners from tax increases. In 2022 the total rate will be about 211.

Its the first revaluation since 1988 under. New Jersey Asks Judge to Delay Atlantic City Casino Tax Ruling as Appeal Proceeds. September 28 2022 1046h.

Property Taxes are delayed. The 2022 total tax rate of 211 rate is based on the new local budgets for schoolscountycity. Account Number Block Lot Qualifier Property Location 18 14502 00011 20.

11 rows City of Jersey City. Property Taxes are delayed. City of Jersey City.

461K x 211 9726. Monday August 7 2017 103802 AM EDT Subject. Property taxes that would be billed for 81 have been delayed and they should be.

You may appeal questions about morris township is jersey city property tax abatements with a downtown. Regardless of filing status the New Jersey credit percentages are. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

Council Authorizes Mailing Of Higher Tax Bills To Homeowners

Welcome To Jersey City R Jerseycity

New Jersey Homeowners Are Getting Some Property Tax Relief

Property Tax Limitation Regimes A Primer Tax Foundation

How Much Cheaper Is It To Live In Jersey City Not Nyc In Terms Of Income Tax Quora

Illinois To Begin Sending Out Property Tax And Income Tax Rebates Cbs Chicago

Nj Property Tax Relief Program Updates Access Wealth

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent

Njcu Developers Set To Reshape Jersey City S West Side Real Estate Nj

Here S The Average Property Tax Bill In Newark Newark Nj Patch

Hudson County New Jersey Wikipedia

Nj Property Tax Relief Here S How Much You Ll Get Back This Year

Jersey City New Jersey Wikipedia

The Official Website Of City Of Union City Nj Tax Department

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me Nj Com

What Are The Good And Bad Neighborhoods Of Jersey City Nj Quora

New Jersey Education Aid Why Jersey City S New Unpiloted Skyscraper Will Help Taxpayers Not Necessarily The Public Schools

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me Nj Com